Last Updated on July 19, 2025

Tire Insurance: Protect Your Tires with Tires Easy

Tire insurance is a specialized type of coverage designed to protect vehicle owners from unexpected tire damage costs. Unlike standard auto insurance, tire insurance specifically covers tire-related issues, offering financial protection and peace of mind.

Tire insurance covers expenses from tire damage due to road hazards like potholes, nails, and debris. Its primary purpose is to alleviate the financial burden of repairing or replacing damaged tires.

Tires are crucial for vehicle safety and performance. Tire damage can lead to costly repairs or replacements, which are financially draining. Tire insurance ensures drivers can manage these expenses without stress, allowing them to drive confidently and safely.

Overview of Tires Easy and Its Offerings

Tires Easy is a leading online retailer that specializes in a wide variety of tires. Known for its commitment to quality and affordability, Tires Easy has become a trusted name in the tire industry, offering products from top brands to meet diverse needs.

Product Range

Tires Easy offers an extensive selection of tires for different vehicle types and purposes:

- Passenger Car Tires: From all-season to performance tires, Tires Easy provides options for everyday driving and specific performance needs.

- Truck and SUV Tires: Durable and reliable, these tires are designed for heavier vehicles, offering enhanced traction and longevity.

- Commercial Tires: Built to withstand the demands of commercial vehicles, these tires ensure safety and efficiency for business operations.

- Specialty Tires: This category includes tires for trailers, ATVs, lawn and garden equipment, and more, catering to a wide range of non-standard vehicle needs.

Key Features

- Competitive Pricing: Tires Easy prides itself on offering competitive prices, helping customers save money without compromising quality.

- Wide Selection: With a vast inventory, Tires Easy ensures customers can find the right tires for any vehicle and driving condition.

- User-Friendly Website: The website is designed to be easy to navigate, with filters and search options to help customers quickly find the needed tires.

- Customer Support: Tires Easy provides excellent customer service, offering support and advice to help customers make informed decisions.

Benefits of Buying from Tires Easy

- Convenience: Shopping online allows customers to browse and purchase tires from the comfort of their homes.

- Free Shipping: Tires Easy often offers free shipping, adding extra value to the purchase.

- Installation Services: Tires Easy partners with local installers to ensure that customers can easily have their new tires installed by professionals.

Customers get high-quality products, excellent service, and peace of mind by choosing Tires Easy, making it a top choice for tire needs.

Importance of Tire Insurance for Vehicle Owners

Tire insurance is crucial for vehicle owners, providing a safety net against unexpected tire damage expenses. This coverage ensures you won’t be left footing a hefty bill due to unavoidable road hazards.

- Financial Protection: Tires can be expensive to replace. Tire insurance covers these costs, saving you from sudden, significant expenses. It acts as a financial buffer, making tire maintenance affordable.

- Peace of Mind: Knowing your tires are covered allows you to drive without worry. Whether it’s a nail on the road or an unexpected blowout, tire insurance protects you, letting you focus on the road.

- Extended Tire Life: Some tire insurance policies include maintenance checks. Regular inspections and timely repairs can extend your tires’ lifespan, giving you more value from your investment.

What Does Tire Insurance Cover?

Tire insurance covers a range of damages, ensuring you’re prepared for various road hazards. Here’s what you can expect from a typical policy:

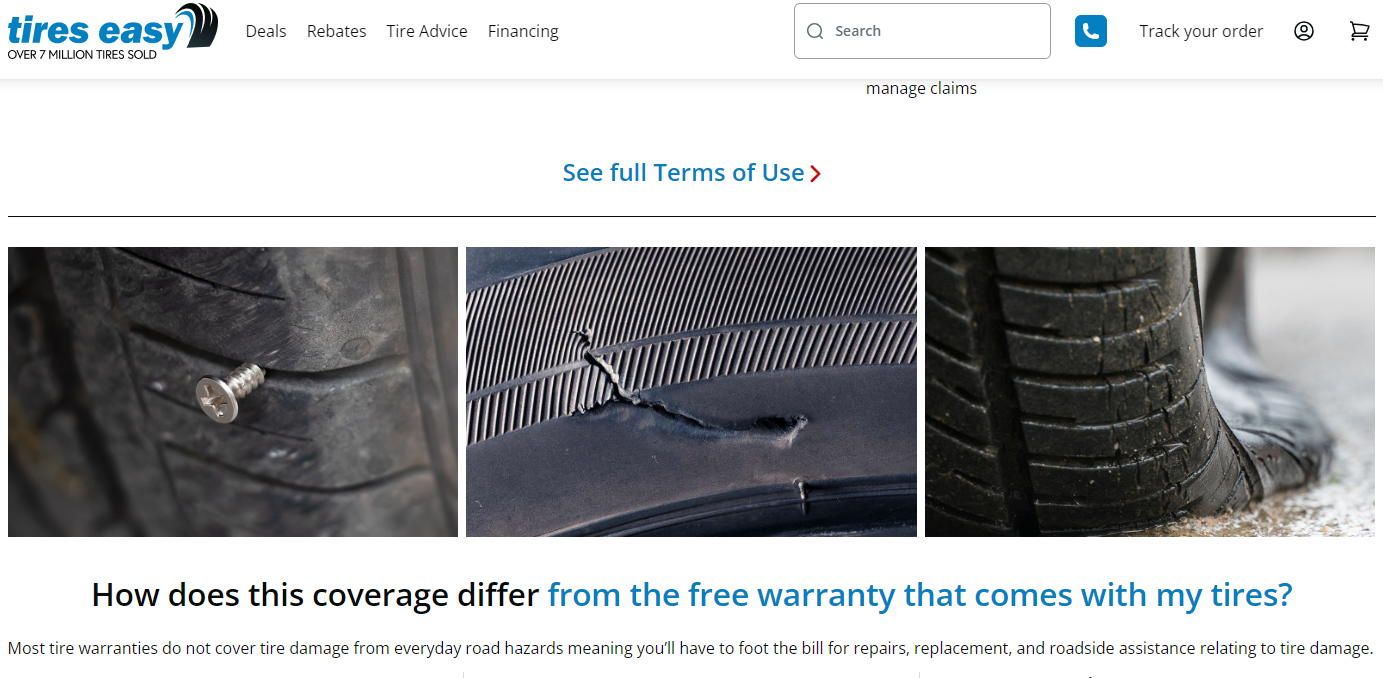

Types of Damages Covered

Tire insurance covers various types of damage, protecting you against common road hazards like potholes, debris, and theft.

External Impacts:

Road hazards can cause significant tire damage. Insurance covers these common issues:

- Potholes: Often unavoidable, potholes can cause severe tire damage.

- Debris on the Road: Sharp objects like nails and glass can puncture tires.

- Curbs and Obstacles: Accidental bumps into curbs or road debris can lead to tire failures.

Theft:

In some areas, tire theft is a real concern. Tire insurance can cover:

- Full Replacement: Replace stolen tires with new ones.

- Associated Costs: Covers labor and any additional components needed for installation.

Flat Tires

Flat tires are a common issue that insurance can cover:

- Punctures: Small holes from nails or other sharp objects can often be repaired.

- Blowouts: Sudden tire failures due to impact damage.

- Valve Stem Issues: Slow leaks caused by valve stem problems.

Additional Coverage Options

Many policies offer extra benefits, enhancing the value of tire insurance:

- Towing and Roadside Assistance: Coverage for towing your vehicle to a repair shop.

- Rental Car Reimbursement: This covers the cost of a rental car if your vehicle is inoperable.

- Labor Costs: Includes the cost of labor for tire repair or replacement.

Benefits of Tire Insurance

Tire insurance offers numerous advantages, ensuring you’re covered for tire-related issues.

Protection Against Unexpected Costs

- Financial Safety Net: Tire insurance provides a financial cushion against unexpected expenses. It covers repair and replacement costs, saving you from sudden, high costs.

- Coverage for Various Damages: Tire insurance covers various issues, from punctures to impact damage and theft, ensuring comprehensive protection.

Peace of Mind While Driving

- Confidence on the Road: Knowing you’re covered allows you to drive confidently without worrying about potential tire damage costs.

- Reduced Stress: Dealing with tire issues can be stressful. Insurance coverage, including roadside assistance and quick repairs, minimizes this stress, ensuring you’re never stranded.

Comparison of Benefits from Different Providers

Comparing policies to find the best fit is essential when choosing tire insurance.

- Coverage Options: Different providers offer varying coverage levels. Look for policies that cover the most common and costly damages.

- Cost and Value: Balance the policy’s cost with its coverage to ensure you get good value.

Customer Reviews and Reputation

Choose providers with positive customer reviews and a reputation for excellent service. A smooth claims process is crucial for a positive experience.

By understanding these aspects, you can choose the best tire insurance policy for your needs, ensuring comprehensive protection and peace of mind on the road.

Cost of Tire Insurance

Tire insurance is an affordable way to protect against unexpected tire damage. Premiums vary based on vehicle type and coverage level.

Typical Costs

Tire insurance is an affordable way to protect your investment. Annual premiums usually range from $10 to $20 per tire, making it a cost-effective solution compared to unexpected tire replacement costs.

Annual Premiums

Annual premiums for tire insurance are relatively low, ensuring that even comprehensive coverage remains affordable. This small investment can save you from significant expenses down the road.

Example Costs

- Basic Coverage: Around $10 to $15 per year per tire.

- Comprehensive Coverage: Typically $15 to $20 per year per tire.

Factors Influencing Cost

Several factors determine the cost of tire insurance, ensuring the premium reflects the specific needs and risks of the vehicle owner.

- Vehicle Type: The type of vehicle you drive impacts the cost. Standard cars often have lower premiums, while trucks, SUVs, and commercial vehicles may have higher premiums due to the cost and wear of their tires.

- Tire Size: Larger and wider tires generally cost more to insure. High-performance and specialty tires also have higher premiums due to increased replacement costs.

- Coverage Level: Basic coverage is cheaper but offers limited protection. Comprehensive plans cost more but provide extensive coverage, including theft, impact damage, and roadside assistance.

- Usage and Driving Habits: Driving high mileage and on rough roads can increase premiums. Conversely, driving mainly on well-maintained roads might result in lower costs.

Provider and Policy Terms

Different providers offer various rates based on their underwriting criteria. Policies with higher deductibles usually have lower premiums, while those with lower deductibles are more expensive but reduce out-of-pocket costs during a claim.

Choosing the Right Tire Insurance

Choosing the right tire insurance involves evaluating your needs and comparing different policies to ensure comprehensive protection.

Considerations

Vehicle Type

Your vehicle type influences the required coverage. Standard cars may need basic coverage, while trucks and SUVs benefit from more robust plans.

Tire Size

Consider the size and type of your tires. Larger or specialty tires may require more extensive coverage to ensure adequate protection.

Desired Coverage

Decide on the level of coverage you need. Basic plans cover punctures and flats, while comprehensive plans offer protection against various issues.

Comparing Benefits and Deductibles from Different Providers

To find the best tire insurance, compare the benefits and deductibles offered by different providers.

Benefits Comparison

Examine what each policy covers. Look for plans that offer extensive protection, including impact damage, theft, and additional services like roadside assistance.

Deductibles

Consider the deductible amount. Policies with lower deductibles cost more but reduce out-of-pocket expenses during a claim. Choose a balance that fits your budget and provides adequate protection.

Provider Reputation and Customer Service

The insurance provider’s reputation and customer service quality are crucial for a hassle-free experience.

Customer Reviews

Check customer reviews to gauge satisfaction levels. Positive reviews indicate reliable coverage and good customer service.

Claims Process

Ensure the provider has an efficient and straightforward claims process. Quick and easy claims handling is essential for minimizing stress when issues arise.

Support Services

Look for providers offering robust support services. 24/7 customer service and helpful support teams can make a significant difference during emergencies.

By considering these factors, you can choose the best tire insurance policy for your needs, ensuring comprehensive coverage and peace of mind on the road.

Conclusion

Choosing the right tire insurance protects your investment and ensures peace of mind. With various options available, it’s crucial to compare different plans and select one that offers comprehensive coverage at an affordable price.

Take the time to evaluate different tire insurance policies. Look for plans that cover the damage you’re most likely to encounter and offer additional benefits like roadside assistance and towing. Check customer reviews to ensure the provider has a good reputation for service and claims handling.

At Tires Easy, we understand the importance of having reliable tires and insurance. We offer a wide range of high-quality tires from top brands, ensuring you find the perfect match for your vehicle. Our tire insurance options provide extensive coverage, giving you confidence and security on the road.

Visit www.TiresEasy.com for a wide range of quality tires and reliable tire insurance options.

FAQs

What is tire insurance?

Tire insurance is a specialized coverage that protects against the cost of repairing or replacing tires damaged by road hazards like nails, potholes, and debris. It provides financial protection and peace of mind by covering unexpected tire-related expenses.

Why do I need tire insurance?

Tire insurance is essential because it helps mitigate the unexpected costs of tire damage. Tires can be expensive to replace, and having insurance ensures you’re not burdened with out-of-pocket expenses for repairs or replacements.

What types of damage does tire insurance cover?

Tire insurance typically covers a range of damages, including punctures from nails and sharp objects, impact damage from potholes and curbs, blowouts, and theft. Comprehensive plans may also include benefits like roadside assistance, towing, and rental car reimbursement.

How much does tire insurance cost?

Tire insurance generally costs between $10 and $20 per year per tire, depending on vehicle type, tire size, and coverage level. This affordable investment can save you from significant repair or replacement costs in the event of tire damage.

-

Automotive Specialist

-

Proofreader

-

Writer